The state budget adopted in 2007 included $1 million in tax breaks to businesses making donations to “scholarship organizations” that funnel financial aid to students attending private and parochial schools. The ACLU and public school advocates objected at the time to this diversion of tax funds to religious institutions, particularly as public school budgets across the state were being decimated. Regrettably, with no fanfare, the House Finance Committee slipped into this year’s budget an amendment increasing the tax break to $1.5 million even as public schools continue to financially struggle.

Tuition Tax Credits (H 5127A as amended)

Status

Passed

Session

2013

Bill number

H 5127A as amended

Position

Oppose

Related Issues

Related content

Arts Organizations Push for Answers in National Endowment for the...

May 12, 2025

ACLU And RWU Law School Clinic Settle Suit Over ACI’s Failure to...

May 7, 2025

Court Denies Preliminary Relief to Arts Organizations

April 2, 2025

Workplace First Amendment Rights (H 5506, S 126)

March 31, 2025

Court Hears Arguments in First Amendment Challenge to Federal Arts...

March 27, 2025

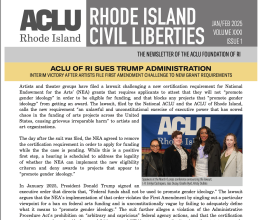

NEWSLETTER - 2025 - Jan/Feb

March 24, 2025

Protections for Libraries (S 238, H 5726)

March 17, 2025

Senate Rules (S 594)

March 10, 2025